The Indian Blogger community has been in a great confusion ever since the Goods and Services Tax (GST) came into effect from 01 July 2017. Suddenly all the bloggers, AdSense users and other freelancers were worried about how to properly comply with the complex GST rules. In India, most of the bloggers make small income by publishing Google AdSense ads on their blogs and websites. Understandably, these blogger were worried that they will now have to part with 18% of their meager income. There are many common questions that were being asked during last few months. “Does a blogger need to register for GST?” and “Do I need to pay GST on AdSense?” were among these questions.

TechWelkin team also considered publishing an article earlier on this issue but honestly we too were confused. There was no clarity on anything. So, we avoided publishing unsubstantiated information. Now, it seems that many GST related questions on blogging, freelancing and AdSense have been clearly answered. Almost all CAs and bloggers have come to consensus on many GST issues. So, today we are giving you concise answer to all your GST related questions. Read on!

Do Bloggers Need to Register for GST?

Yes, if you are earning from your blog, you would need to register for GST and get a GSTN number for yourself. But do not worry at all. GST registration a simple and easy process. Your CA can easily get you registered within minutes. CAs charge about Rs. 3000 for GST registration.

Do I Need to Pay GST Tax on the Blogging Income?

Bloggers earn money from various sources. On money made from some of the sources, you do need to pay GST and on some others you don’t. Let’s see:

- Google AdSense: Income made from Google AdSense is exempted from GST. To be precise, you have to pay 0% GST on AdSense income (reasons will be explained later in the article). This means, you have to file GST returns but you don’t need to pay any GST on it.

- Google AdX Ads: If you’re using AdX ads, then you will have to pay 18% GST if your AdX supplier is located in India.

- Affiliate Ads / Links: If the client is located outside India, you don’t need to pay GST on affiliate income. But if your affiliate client in located within India, you have to pay 18% GST. For example, if you are running affiliate ads for a web hosting company whose office is located in USA, you don’t have to pay GST. But if you are running ads of an Indian web hosting company then you have to pay 18% GST.

- Direct Ads: These are the advertisements that you source yourself. Unlike AdSense and affiliate ads, you have to raise invoice for getting direct ads. In that invoice, you need to ad 18% GST and then pay this 18% amount to the government.

- Advertorials and Sponsored Articles: Just like direct ads, you have to take 18% GST from your client and then pay it to the government.

- Ad Networks Other than Google AdSense: The same rule applies as in case of affiliate ads.

Why I don’t Need to Pay GST on AdSense?

Google sends you payment from Singapore. As a result, Google becomes your overseas client and your publishing of AdSense ads would be treated as export of services. The export of services comes under 0% GST tax slab.

There is another thing. Because you do not raise invoice to Google and Google does not give you 18% extra, so it does,’t make sense to pay 18% tax from our own pocket. If you could raise an invoice to Google to ask for your AdSense payment, then you could add 18% GST in that invoice… and then in turn you could pay this amount to the government. Thankfully export of services is taxed at 0% — so, AdSense publishers don’t need to pay GST from their own pocket.

Why do I Need to File GST Returns Even if I don’t Need to Pay Any Tax?

We know that it is pretty annoying and illogical. But that’s how it is. If your blogging income is solely coming from AdSense, then you don’t have to pay GST — but you will still have to file nil GST return.

You have to file three GST returns every month.

Update: The government has given some respite. In the 22nd meeting of the GST Council on 6 October 2017, it has been decided that now, people with annual turnover of less than 1.5 crores will have to file quarterly GST returns instead of monthly returns.

So if you are earning less than 1.5 crores from your blog, you need to file GST returns every three months. Otherwise — seriously?!!! are you making more than 1.5 crores from blogging?!!! ;-) — you have to file monthly returns.

What are the Documents Required for GSTN Registration?

- Scanned copy of PAN card

- Scanned copy of passport size photograph

- Trade name of your business (if you haven’t registered any company, just fill your own name)

- Address of principal place of business (if you are an individual, and you are working from your home, just get an NOC letter from the person who owns your home)

- Proof of principal place of business (scanned copy of electricity bill or telephone bill will do)

- Latest bank statement

- A cancelled cheque

- Name of services your provide

Take these documents to a CA and they will register you at the GSTN portal within minutes.

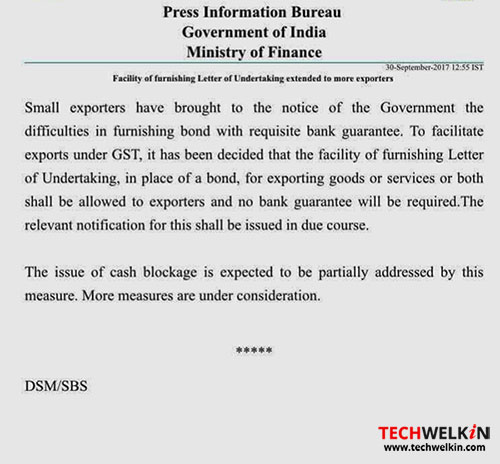

Do I Need to Submit a Bank Guarantee for Filing Nil Returns for Export of Services?

Earlier the GST Council had mandated that exporters will have to provide a bank guarantee along with their GST returns. But recently, the government issued a notification which exempted small exporters from giving bank guarantee. As an AdSense publisher, you export services and thus you’re an exporter. So, you no longer need to give bank guarantee.

Instead of a bank guarantee, you would need to provide a Letter of Undertaking. Your CA can provide you the format of this letter. You just need to take a printout and sign it.

We are giving a copy of the said notification for your reference:

Do I also Need to Pay Income Tax?

Yes, as a freelancer or blogger you have to file income tax returns as usual. If you have to pay GST, that does not mean that you would not need to pay income tax. If your income is in taxable slab — you would have to pay income tax accordingly.

We hope that this article clarified your major doubts about GST on AdSense and other blogging income. If you have any more questions or information, please share with us in the comments section. We will try our best to help you.

Google does not provide any option to send invoices to google. In GST it is compulsory to issue an invoice for every supply. My question is how can I send invoice to google.

That’s great, Lalit. Your post answered most of my queries on Indian blogging taxation. Thanks

Thanks for this useful article.

Are there any specific things which need to be kept in mind for GST for Online information and database access or retrieval services (OIDARS)?

Great information on GST Filing with Percentages, It’s really useful for me!!

I have been getting remittance for a database and data processing work to my bank account but from the past two months I am being charged around 20%, when asked the bank says it is gst. Can gst be deducted like this? The sender does not have any idea about this.

It’s weird. The bank should not deduct GST. You should contact the bank and if they don’t give you a satisfying explanation, you may contact consumer court.

Hi

Thanks for the article.

You still haven’t stated any information on the exemption limit for bloggers.

In the 22nd meeting on 6th October it was stated that now inter-state services upto 20L are exempted. But blogging and YouTube also generates income from outside countries. Is that why you are saying that we have to register compulsorily?

What if the server of my website is located in US. So basically I am providing advertising estate on a website hosted in USA and not India. Is it still considered export?

And what about income from selling apps on play store?

Please do reply.

Thanks